Crypto ETF is, like, my latest obsession, mostly cause I got burned trying to figure out crypto the hard way. I’m in my sweaty Miami apartment, surrounded by empty Yerba Mate cans and a fan that sounds like it’s dying. It’s January 2025, and I’m staring at my laptop, crypto ETF charts blinking at me like they know I’m clueless, my coffee cold and my dog snoring loud enough to wake the neighbors. I’ve lost money, made some back, and spent way too many nights googling “what is a crypto ETF” while sweating through my tank top. Here’s my messy, real-deal take on what crypto ETFs are and how they work, from one confused dude to you. Sorry for typos, I’m running on fumes and FOMO.

Why I’m Freaking Out About What a Crypto ETF Is

Last year, I thought I was a crypto pro. Threw $500 into some random coin cause a Reddit thread said it’d “10x.” Yeah, it crashed, and I was eating canned beans for weeks, cursing my Robinhood app in my humid apartment. Then I heard about crypto ETFs, and it was like, wait, I can invest in crypto without losing my mind? Figuring out what is a crypto ETF saved my butt from another YOLO disaster. Here’s what I’ve learned after screwing up big time.

The Basics of What a Crypto ETF Is

Okay, so a crypto ETF is like a stock, but for crypto. It’s an exchange-traded fund that tracks crypto prices, like Bitcoin or Ethereum, without you having to buy coins directly. I learned this from Investopedia, which I read at 2 a.m. while eating leftover pizza. Last week, I was at a Miami coffee shop, looking like a total dork with my notebook full of ETF scribbles. Here’s the deal:

Less hassle: No dealing with sketchy crypto exchanges or losing your private key (been there).

Tracks crypto: It follows coins like BTC or ETH, so you don’t need a wallet.

Traded on exchanges: You buy it on apps like Fidelity or TD Ameritrade.

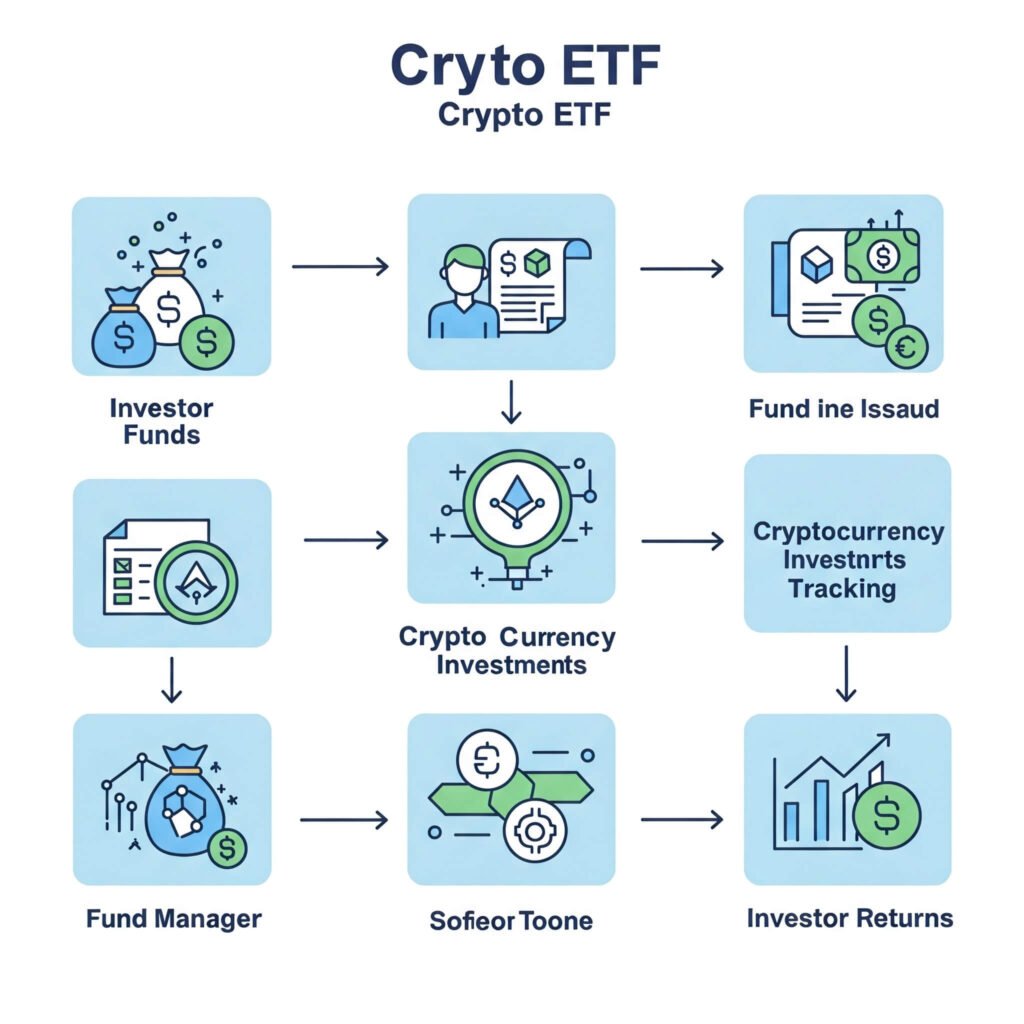

How Crypto ETFs Actually Work

Crypto ETFs are like a cheat code for crypto investing. You buy shares in the ETF, and it holds the crypto for you, kinda like a middleman. I tried buying Bitcoin directly once and lost $200 cause I forgot my wallet password. ETFs are way easier, but they’ve got fees. CoinDesk has good articles on how they work.

Why Crypto ETFs Are Kinda Cool for Crypto Investing

Here’s why I’m into crypto ETFs now:

Easy to buy: I got some through my Robinhood account, took like 5 minutes.

Diversification: Some ETFs track a bunch of coins, so you’re not screwed if one tanks.

Regulated: They’re on legit stock exchanges, so less sketchy than some crypto apps.

Outbound Link: Stay updated on crypto regulations at CoinDesk.

My Biggest Crypto ETF Mistake (Learn from Me)

Time to get real. I bought into a crypto ETF last year without checking the fees. Thought I was a genius, then saw I lost $50 to management fees. I was refreshing Yahoo Finance like a maniac, watching my money get eaten. Check the expense ratio before you buy—Morningstar has good data on this. Don’t be dumb like me, okay?

Tips to Get Started with Cryptocurrency ETFs

Here’s what I do now to not screw up:

Watch the fees: Some ETFs charge like 2%. That’s a lot when you’re broke like me.

Read the prospectus: Sounds boring, but it tells you what the ETF tracks. I found one on Fidelity’s site.

Start small: I put $100 in a Bitcoin ETF last month, and it’s less stressful than buying coins.

Wrapping Up My Crypto ETF Rant

Look, figuring out what is a crypto ETF is like finding a less stressful way to mess with crypto. I’m still a hot mess—my desk’s got more coffee stains than dollars—but I’m learning. Crypto ETFs are easier than buying coins, but you gotta do your homework. Check CoinDesk for news or Investopedia for basics. Let’s make smarter crypto moves in 2025, yeah?