DeFi investment opportunities are my new thing, mostly cause I got wrecked trying to play crypto last year. I’m in my tiny Philly apartment, surrounded by empty cheesesteak wrappers and a fan that sounds like it’s about to explode. It’s January 2025, and I’m glued to my laptop, DeFi apps like Uniswap flashing at me like they know I’m clueless, my coffee cold and my cat chewing my headphone cord. I’ve lost money, made a little, and spent way too many nights googling “what the hell is DeFi” while sweating through my T-shirt. Heres my sloppy, real-deal take on DeFi investment opportunities, from one broke dude to you. Sorry for typos, I’m running on Red Bull and regret.

Why I’m Losing It Over DeFi Investment Opportunities

Last year, I thought I was a crypto genius. Threw $350 into some sketchy coin cause a Twitter bro said it’d “go to the moon.” Yeah, it tanked, and I was eating stale pretzels for weeks, cursing my MetaMask in my stuffy apartment. Then I found DeFi, and it was like, wait, I can make money without a bank screwing me? DeFi investment opportunities are like crypto on crack, but they’re confusing as hell. Here’s what I’ve figured out after screwing up big time.

What Even Are DeFi Investment Opportunities?

DeFi’s short for decentralized finance, which is like banking but on the blockchain, no suits involved. Think lending, borrowing, or earning interest without a bank saying “nah.” I learned this from CoinDesk, which I read at 3 a.m. while munching on leftover cheesesteak. Last weekend, I was at a coffee shop in Fishtown, looking like a total nerd with my notebook full of DeFi scribbles and grease stains. Here’s the deal:

High risk, high reward: You can make bank, but you can also lose your shirt.to lend crypto assets and earn interest, often at rates far higher than traditional savings accounts. According to DeFi Pulse, over $100 billion is locked in DeFi protocols as of April 2025, showcasing the sector’s explosive growth.

No banks: You use apps like Uniswap or Aave to trade or lend crypto.

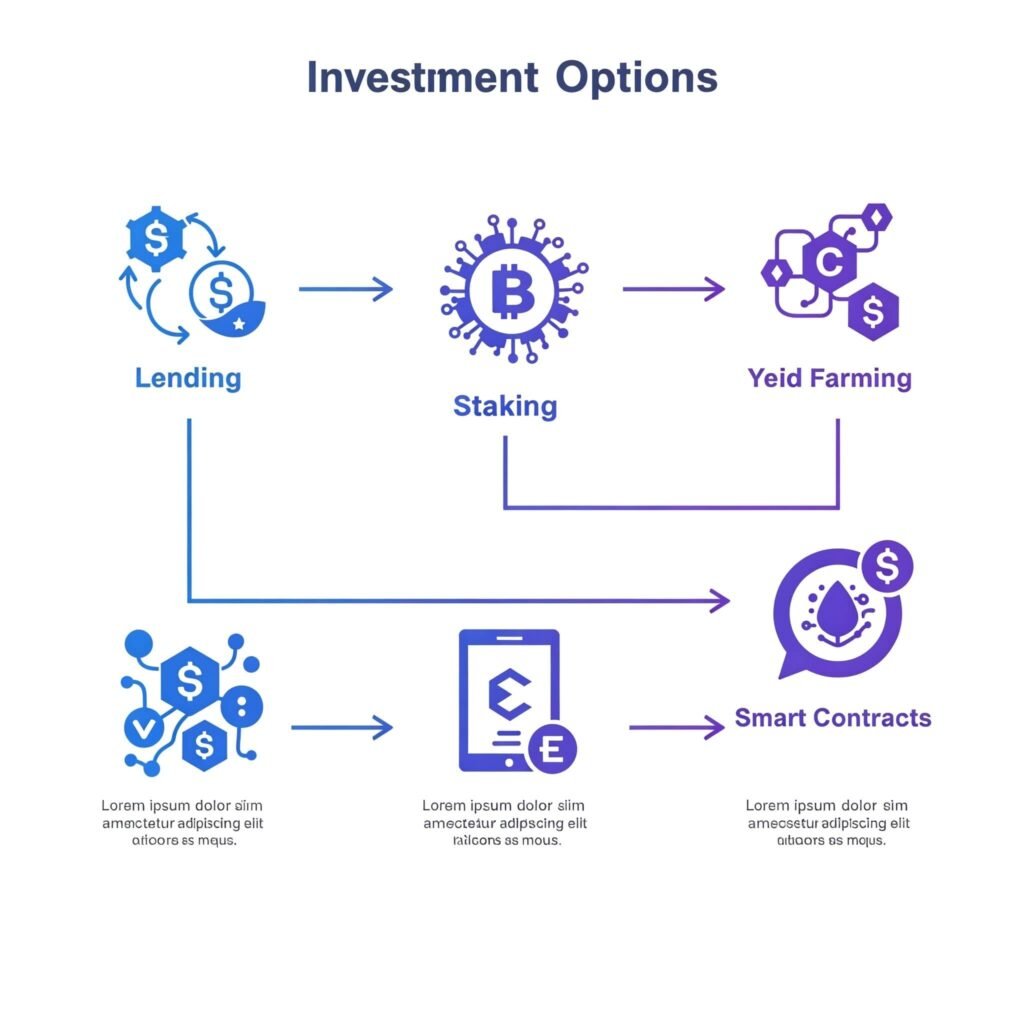

Smart contracts: Code runs it, not some Wall Street dude. Sounds cool, but I barely get it.

How to Dive Into DeFi Investment Opportunities

DeFi’s like a casino with better graphics, and I’m no pro, but I’ve got some tricks. You can stake coins, lend them, or try yield farming (still don’t fully get it). I tried staking on Compound and made $12, which bought half a beer. Here’s how DeFi investment opportunities work, based on my half-assed experience.

1. Staking for DeFi Investing

Staking’s like locking up your crypto to earn interest. I staked some ETH on Lido last year, made like $10, and felt like a crypto king. It’s risky, but CoinGecko has good info on staking platforms. Decent way to jump into DeFi investment opportunities without going full YOLO.

2. Yield Farming for Crypto DeFi

Yield farming’s where you lend your crypto to earn crazy returns. I tried it on Uniswap, threw in $80, and made $7 before I panicked and bailed. It’s like gambling, but with more math. Check DeFi Pulse for top platforms. Risky as hell, but a hot DeFi investment opportunity.

3. Liquidity Pools for DeFi Strategies

Liquidity pools are where you throw your crypto into a pool for others to trade, and you get fees. I tried one on SushiSwap and made $6, but I was sweating bullets. It’s a cool way to mix up DeFi investment opportunities, but check Reddit first.

My Biggest DeFi Screw-Up (Learn from Me)

Here’s where I get raw. I fell for a shady DeFi project last year cause some Discord dude hyped it up. Lost $250 in like four days when it rug-pulled (that’s when the devs ghost with your cash). I was refreshing CoinMarketCap like a maniac, watching my money vanish. Check a project’s team and audits before diving into DeFi investment opportunities—don’t be an idiot like me.

Wrapping Up My DeFi Investment Rant

Look, DeFi investment opportunities are like a wild ride with no seatbelts, but they’re kinda dope. I’m still a hot mess—my desk’s got more cheesesteak grease than dollars—but I’m learning. Start small, research like crazy, and don’t bet your rent money. Check CoinDesk for news or DeFi Pulse for stats. Let’s make some smart DeFi moves in 2025, cool?