Investment basics, man, they’re like trying to cook a fancy meal in my tiny Boston apartment with a half-broken stove—total disaster, but kinda exciting. I’m sitting here, my table covered in takeout boxes, my laptop glowing with stock charts, and the radiator’s clanking like it’s laughing at me. My coffee’s cold, my socks don’t match, and I’m tryna figure out how to grow my wealth without screwing it all up. Growing wealth as a beginner is scary as hell, but I’m laying out all my dumb mistakes here so you don’t gotta make ‘em. Here’s my messy, real-deal story of diving into investment basics, straight from my cluttered life.

Why Investment Basics Hit Me Hard

Investment basics are like the rulebook I never got for handling money. Last winter, I was in a CVS, clutching a $5 bill, debating if I should buy chips or toss it into some stock I saw hyped up on X. Spoiler: I got the chips. But that moment stuck with me—why was I so clueless about making my money work? I read on Investopedia that investing’s about putting cash into stuff like stocks or bonds to make more money over time. Sounds simple, but I was terrified I’d lose my tiny savings, like that time I lost my keys in a snow pile.

Time’s your friend. Compound interest is like magic—check out NerdWallet’s guide for the lowdown.

Start small, yo. You don’t need a ton to begin. I threw $30 into an app and was sweating bullets.

You’ll mess up. I dumped $100 into a stock ‘cause some guy on X swore it was a sure thing. It tanked. Always do your own research.

My Biggest Flops Learning Investment Basics

Growing wealth as a beginner is like trying to ride a bike in a Boston blizzard—wobbly and painful. My worst screw-up? Thinking I could outsmart the market. I’d sit in my freezing apartment, glued to my phone, refreshing stock prices like a total nutcase. Buy high, freak out, sell low—that was my vibe. The SEC’s site says timing the market’s a trap for most of us. Now I do dollar-cost averaging, which is just tossing in a little money regularly, no matter what the market’s doing. It’s boring but keeps me sane.

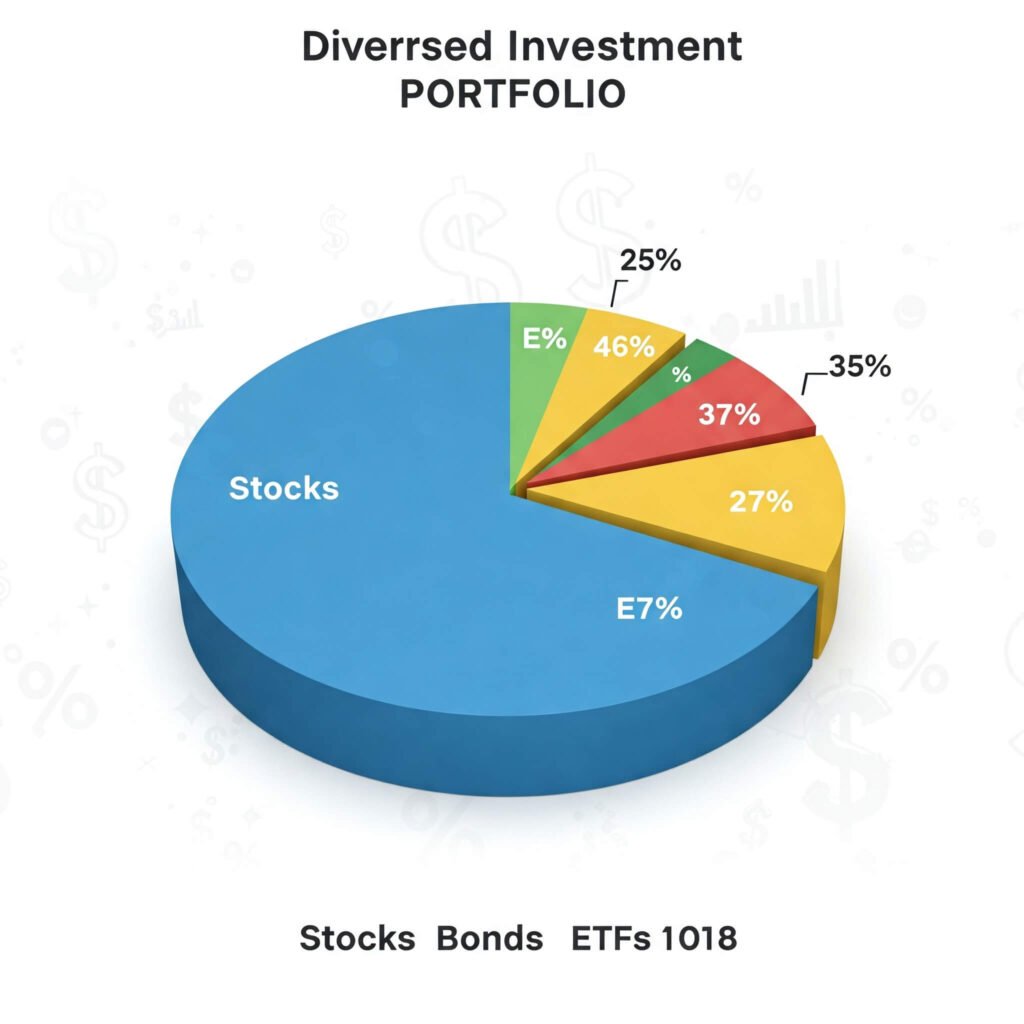

Oh, and I totally ignored diversification. I put all my cash into one tech stock ‘cause I thought I was a genius after scrolling X for 20 minutes. When it crashed, I was eating ramen for weeks. Spread your money around—stocks, bonds, ETFs. It’s like not betting your whole paycheck on one bad poker hand.

How I Stopped Panicking About Investment Basics

I used to lose sleep over this stuff. I’d be up at 2 a.m., my neighbor’s dog barking like crazy, worrying I’d end up broke and crashing on my buddy’s couch. Here’s what helped me chill:

- Robo-advisors are a lifesaver. Apps like Wealth front or Betterment do the hard work. I started with one, and it felt like having a financial babysitter.

- Ditch the hype. I stopped chasing sketchy X tips and read The Simple Path to Wealth. It’s like your cool uncle breaking down money.

- Small wins matter. My $30 growing to $32 felt like I won a prize. Celebrate the little stuff.

Investment Basics Tips I Wish I Knew

Okay, here’s the real talk, what I’d tell my past self about growing wealth:

- Have a goal, even a lame one. Mine was “not freaking out about rent forever.” It kept me going.

- Index funds are dope. They’re cheap, spread out, and low-stress. Vanguard’s site explains why they’re solid.

- Don’t check your portfolio every 5 seconds. It’s like refreshing X to see if your crush posted—bad for your brain.

- Talk to people. I joined a Boston investing group. Half of us were lost, but we figured it out together.

I still mess up. Like, last week I almost bought some weird crypto ‘cause a dude at a coffee shop swore it was “the future.” But I’m learning to slow down and stick to investment basics. Growing wealth is slow, like waiting for the T in a snowstorm.

Wrapping Up My Take on Investment Basics

Look, investment basics aren’t rocket science, but they’re not a TikTok trend either. I’m still figuring this out, sitting in my messy apartment with snow piling up outside, hoping my tiny portfolio doesn’t tank. Growing wealth as a beginner is about starting small, screwing up, and learning without losing your mind. My advice? Try a robo-advisor or index fund, and don’t let fear stop you. Got your own money mishaps or questions? Hit me up on X—I wanna hear how you’re tackling this stuff.