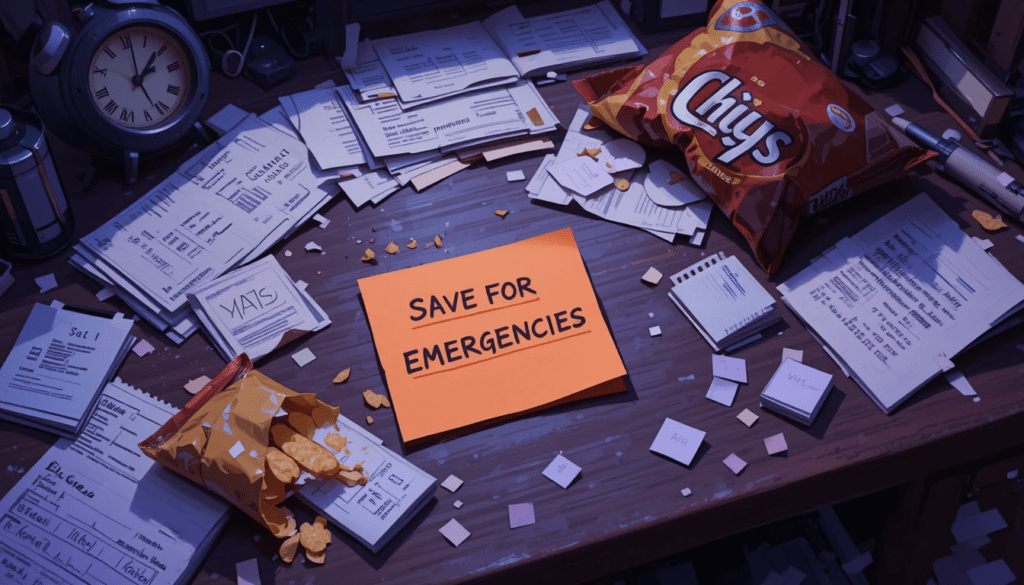

Okay, the importance of building an emergency fund slapped me in the face, sitting in my Nashville apartment, the ceiling fan creaking like it’s mocking my broke butt. I was a mess—$30 in my account, a maxed card from a “vintage vinyl” obsession (so dumb), and a vet bill that made me wanna cry. I’m surrounded by chip crumbs and a budgeting app I barely get. I’ve got $1,800 saved now, but it’s been a sloppy, American, hot-mess journey to save for emergencies. Here’s my raw take, typos, soda stains, and all.

Why No Emergency Fund Was My Biggest Fail

Picture this: I’m at a Waffle House in East Nashville, scarfing down hashbrowns, when my phone pings with a “low balance” alert. No savings, and my car needed tires. An emergency fund isn’t just nice—it’s your lifeline when life yeets you into chaos. To get the importance of building an emergency fund, you gotta know your financial mess. For me, it was zero savings and a $400 tire bill. You been there?

- Check your money. I used Personal Capital to see my financial disaster. Found $30 in dumb fees. Fixed ‘em, saved some.

- Track spending. Apps like Mint are free and kinda addicting. I checked mine like I’m scrolling X for drama.

- Face the facts. I had $30 in savings and a card at 90% utilization. Yikes.

My Sloppy Guide to Building an Emergency Fund (It Kinda Worked)

I’m no finance wizard, alright? I’m just a guy who panic-Googled “emergency fund tips” at 3 a.m. while munching stale chips. But I hacked together a plan to build a rainy day fund that didn’t make me wanna yeet my phone. Here’s what I did, with all the embarassing bits.

Step 1: Start Tiny, Like Super Tiny

I thought you needed thousands for an emergency fund. Nope. Even $15 a month helps. I set up auto-transfers to a savings account with Ally Bank. Saved $400 in a year. Once, I forgot to check my budget and bought a $20 vinyl—big oops.

Step 2: Cut Stupid Spending (Like My Vinyl Habit)

I was dropping $80 a month on records and takeout. To save for emergencies, I audited my spending with YNAB. Cut $60 by cooking at home and skipping coffee runs. One time, I bought a “deal” record that was scratched—wasted $15. Never again.

Step 3: Hustle for Extra Cash

I needed more money to build an emergency fund. Started selling old clothes on Poshmark—made $150 a month. NerdWallet has good side hustle ideas. But I once forgot to ship an item and got a bad review—felt like a goof, but it added up.

Step 4: Keep It Untouchable (No Cheating!)

I used to “borrow” from my savings for dumb stuff. Big mistake. To build a rainy day fund, I opened a high-yield savings account with Discover. It’s harder to touch. I accidentally sent $50 back to checking once—took days to fix. Don’t do that.

My Dumb Mistakes (Learn From Me)

I screwed up plenty. Ignored a $250 vet bill, thinking it wouldn’t hit my credit. Spoiler: it did. Also, dipped into my emergency fund for a concert ticket—lost $100 in progress. Check accounts with Equifax. Oh, and I wrote the wrong savings amount in my app once—messed me up for weeks. Those “save quick” ads on X? Scams. Stick to Consumer Financial Protection Bureau.

Weird Stuff I Learned About Emergency Savings

Here’s the tea: I thought the importance of building an emergency fund would feel like winning a bet. Nope. It’s slow, and I still stress about bills. But seeing my savings grow gave me this shaky, “maybe I’m not screwed” vibe. Also, Bankrate says $1,000 is a solid starter goal. Who knew?

- Small wins matter. $15 a month becomes $180 a year.

- Life’s messy. Car repairs, vet bills—stuff happens.

- Patience sucks. Saving takes months, not days. Ugh.

Wrapping Up This Emergency Fund Mess

Alright, I’m just a dude in Nashville, surrounded by chip crumbs and a savings account that’s finally not a disaster. The importance of building an emergency fund is real, but it’s messy, and you’ll feel like a goof sometimes. Start small, cut dumb spending, and don’t make my stupid mistakes. Got questions? Slide into my X DMs or check myFICO. Now, go build a rainy day fund and tell me how it goes, cool?