Crypto wallets, yo. When I first dove into crypto, I thought a crypto wallet was just some app where I’d chuck my Bitcoin and be done. Boy, was I wrong. I’m sitting here in my tiny Brooklyn apartment, coffee mugs everywhere, the faint smell of burnt bagel from this morning’s breakfast disaster still hanging in the air. My laptop’s fan is whining like it’s about to quit, and I’m just trying to make sense of my crypto wallet journey. It’s been a mess, but here’s my raw, kinda flawed take on how to store your digital assets safely—complete with all the stupid stuff I did wrong.

Why Crypto Wallets Are a Big Freakin’ Deal

Okay, so crypto wallets aren’t just some shiny app on your phone. They’re like the keys to your digital cash—Bitcoin, Ethereum, whatever. Without ‘em, you’re screwed. I learned this the hard way back in 2021 when I left some Ethereum on a shady exchange. Picture me, pacing my shoebox apartment in Williamsburg, sweating bullets when I realized the exchange got hacked and my crypto was gone. Total gut punch. A crypto wallet—hot (online, easy) or cold (offline, Fort Knox vibes)—is what keeps your private keys safe, proving you own your digital assets.

Here’s the lowdown, from my slightly traumatized brain:

- They don’t hold your crypto. Your coins are on the blockchain; the wallet just has the keys. Blew my mind when I learned that.

- Hot wallets are convenient but sketchy. Apps like MetaMask are great for quick trades, but hackers love ‘em too.

- Cold wallets are the real deal. Hardware like Ledger keeps your keys offline. Wish I’d known this before my Ethereum went poof.

Hot Wallets: Super Easy, Super Risky, Super Me Screwing Up

Hot wallets are like that friend who’s a blast but always forgets their wallet at the bar. They’re online, software-based, perfect for quick crypto stuff. I got into hot wallets during the 2021 NFT craze—wanted to buy some digital art, thought I was cool. Big oops. I downloaded some random wallet app from the App Store without checking if it was legit. Next thing I know, I’m up at 2 a.m., heart pounding, cuz my $200 in crypto just vanished. Like, gone gone.

Here’s what I wish I’d known about hot wallets:

- Only use trusted ones. MetaMask or Coinbase Wallet are solid. Read reviews, don’t be dumb like me.

- Guard your seed phrase like it’s gold. That 12-24 word phrase is your lifeline. I wrote mine on a Post-it and stuck it on my fridge. Yeah, genius move, right?

- Turn on 2FA. I didn’t, and I paid for it. Enable two-factor authentication everywhere—your wallet, your email, all of it.

Hot wallets are awesome for small trades, but they’re only as safe as you are. I learned to treat my seed phrase like it’s the key to a secret bunker, not a grocery list.

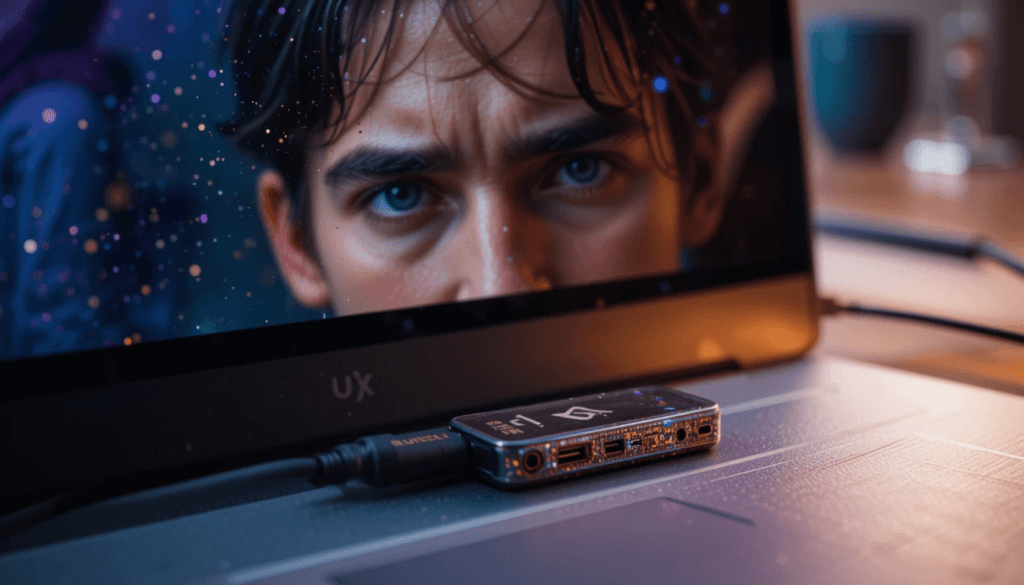

Cold Wallets: My New Obsession for Crypto Storage

After my hot wallet disaster, I was like, “Never again.” So I got a cold wallet—a hardware device that keeps your keys offline. I bought a Ledger Nano X last year, and it’s like carrying a tiny safe in my pocket. I’m fiddling with it now, sitting at my desk, the matte black catching the light from my cheap IKEA lamp. It ain’t pretty, but it’s saved my bacon.

Cold wallets are where it’s at for secure crypto storage. Here’s why I’m hooked:

- Offline is the best. No internet, no hackers. My Ledger’s never touched Wi-Fi, and I sleep better for it.

- They’re not perfect tho. I forgot my PIN once and spent a week freaking out, thinking I’d locked myself out. Pro tip: write your PIN somewhere safe (not the fridge, duh).

- Worth the cash. Dropping $150 on a Ledger hurt, but losing $200 to a hack hurt more.

If you’re serious about your digital assets, get a cold wallet. Ledger or Trezor are solid bets. They cost a bit, but peace of mind ain’t cheap.

My Best Tips for Keeping Crypto Wallets Safe

Alright, I’ve made every crypto wallet mistake in the book. It’s embarrassing, but I’m spilling it so you don’t have to learn the hard way. Here’s my hard-won advice for secure crypto storage, straight from my chaotic life in Brooklyn:

- Back up your seed phrase right. Get a metal backup like Billfodl and stash it in a fireproof safe. Not a Post-it, okay?

- Double-check addresses. Sending crypto to the wrong address is like mailing cash to Narnia—it’s gone. I sent $50 of Bitcoin to a typo’d address once. Still mad.

- Stay paranoid, yo. Phishing scams are everywhere. If a link looks even a tiny bit weird, don’t click. I almost got got by a fake MetaMask email.

- Mix it up. Keep a little in a hot wallet for trading, and the rest in a cold wallet for safety. Like a checking and savings account, but for crypto.

Wrapping It Up: My Crypto Wallet Journey’s a Hot Mess, But It’s Mine

So yeah, crypto wallets are a wild ride. I’ve lost money, panicked, and learned a ton about keeping my digital assets safe. Right now, with Brooklyn traffic buzzing outside and the smell of my neighbor’s BBQ sneaking in, I’m still no crypto guru. But I’ve got my Ledger, my seed phrase locked up tight, and a better grip on blockchain wallets. If I can figure this out, you totally can.